What is a Virtual CFO? Complete Guide for Indian Businesses

A Virtual CFO (vCFO) is a financial expert who provides strategic CFO-level guidance to your business on a part-time, remote, or project basis - without the ₹25-50 lakh annual cost of a full-time Chief Financial Officer.

Unlike accountants or bookkeepers who handle day-to-day transactions, a Virtual CFO focuses on financial strategy: cash flow optimization, fundraising support, profitability analysis, and helping you make better business decisions.

In India, Virtual CFO services typically cost between ₹60,000 to ₹3,00,000 per month depending on your business complexity and needs.

This guide covers everything Indian business owners need to know about Virtual CFOs - what they do, when you need one, how much they cost, and how to choose the right partner.

If you have a startup or growing business, it's likely that you've reached a point where you require some financial expertise - but bringing in a full-time CFO just isn't in the books (or budget). That's where the idea of a Virtual CFO exists.

What exactly is the meaning of a Virtual CFO in layman's terms?

A Virtual CFO (or vCFO) is a financial professional who serves your business remotely - typically part-time to assist you in making better financial choices, controlling cash flow, planning growth, and staying compliant. Consider them your strategic finance partner, minus the full-time cost.

What Does a Virtual CFO Actually Do?

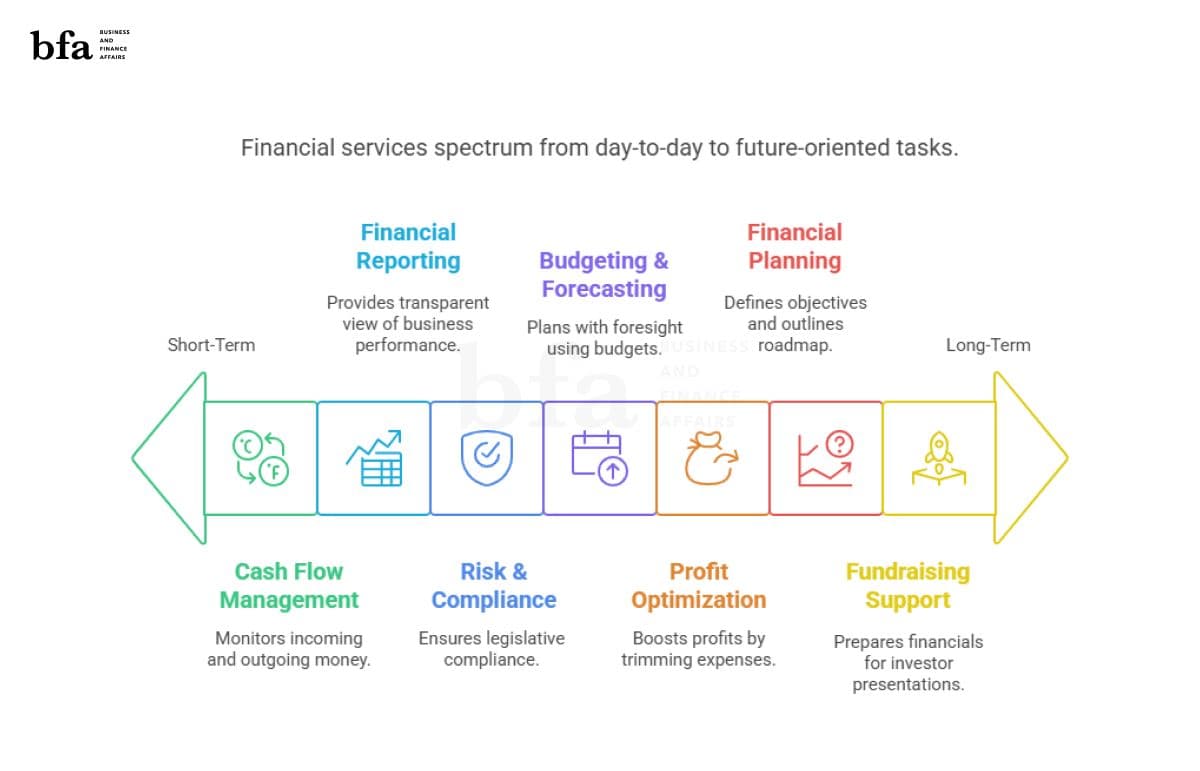

A Virtual CFO wears many hats, but their core function is translating your financial data into strategic decisions. Here's what they typically handle:

Financial Planning & Strategy

Building 12-36 month financial roadmaps, setting targets, and creating the plan to hit them. For Indian SMEs, this often includes planning around GST cash flow cycles and seasonal business patterns.

Cash Flow Management

The #1 reason Indian businesses fail is cash flow mismanagement. A Virtual CFO builds forecasting systems (typically 13-week rolling forecasts) so you never get surprised by a cash crunch.

Real example: A Bangalore SaaS startup we worked with had unpredictable cash flows and late receivables. After implementing a structured forecasting system, they saw a 30% reduction in cash shortfalls within one quarter.

Budgeting & Forecasting

Creating realistic budgets and comparing actual performance against them monthly - something 70% of Indian SMEs don't do systematically.

Financial Reporting & MIS

Translating your Tally/Zoho data into dashboards and reports you actually understand. The goal: know your business health at a glance.

Compliance & Risk Management

In India, this is critical. GST across 28 states, TDS, ROC filings, professional tax - the compliance burden is heavy. A Virtual CFO ensures you never miss a deadline or face penalties.

Fundraising & Investor Readiness

If you're raising capital, a Virtual CFO prepares your financials for due diligence, builds projection models, and often joins investor calls to handle financial questions.

Profitability Optimization

Finding where you're bleeding money - redundant software, bad vendor contracts, underpriced services - and fixing it.

Why Do Companies Use a Virtual CFO?

Understanding the Virtual CFO definition allows you to understand why increasing numbers of companies are adopting this strategy. Here are a few huge reasons:

- It's Cost-Effective: Hiring a full-time CFO is expensive. A Virtual CFO provides you expert input without a high salary.

- Scales With You: As your company expands, your Virtual CFO can increase their involvement.

- Flexible Support: Whether you need someone for a few hours a month or for a large funding round, they can adjust.

- Access to Expertise: Virtual CFOs typically bring extensive experience across multiple industries, offering insights tailored to diverse business needs.

- Time-Saving: With a clear financial strategy in place, you can focus on what truly matters - growing your business.

When is the right moment to bring a Virtual CFO on board?

A Virtual CFO comes in very handy at particular times in your business life cycle, such as:

- When rapidly expanding and having assistance with your finances.

- During raising capital, to prepare the finances for your investors and be there to aid in due diligence.

- When cash flow is tight and you require a wiser approach to keep floating.

- When profitability or strategic financial choices require clarification.

- When managing intricate matters, such as overseas taxes or compliance.

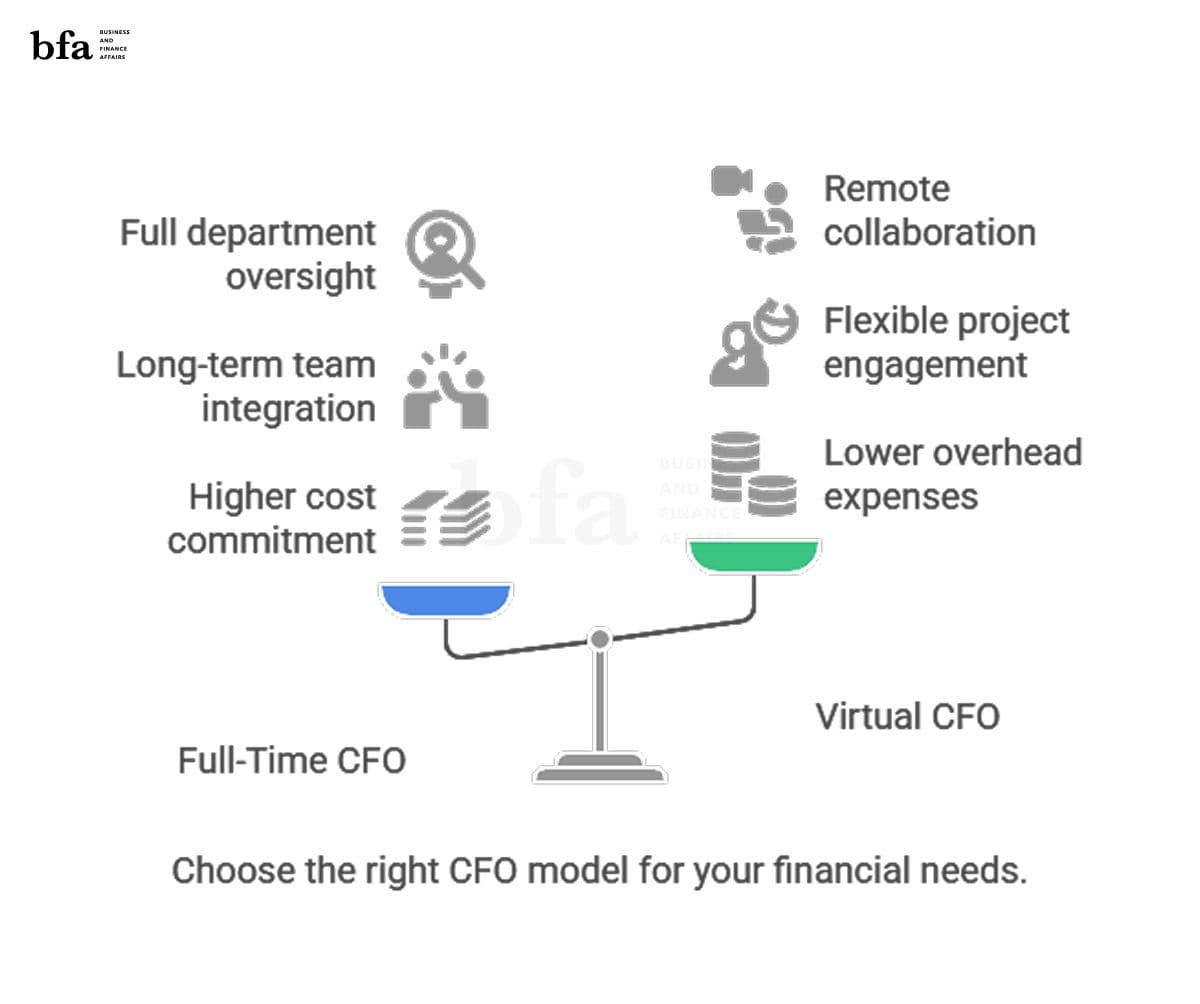

Virtual CFO vs. Full-Time CFO-What's the Difference?

Both positions concentrate on financial leadership but differ in the way they're organized.

A full-time, permanent CFO becomes a long-term part of your team, working in-house and potentially overseeing the entire finance department, though at a significantly higher cost.

A Virtual CFO, on the other hand, is typically an outsourced colleague who works remotely and is contracted on a part-time, flexible, or project basis. Same intelligence - lower overhead.

What to Look for When Choosing a Virtual CFO for Your Business

Having the right individual on board can make all the difference. Look for:

- Industry Expertise: Choose someone who has knowledge of your business model and the specific financial challenges of your industry.

- Established Track Record: Request references or success stories from comparable clients.

- Service Alignment: Ensure they provide what you require-some will specialize in compliance, others in strategy or fundraising.

- Good Communication: Since you’re working remotely, they should be responsive, clear, and easy to collaborate with.

FAQs About Virtual CFOs

Q: How much does a Virtual CFO cost?

A: Costs can vary widely depending on experience and scope but are generally more affordable than full-time CFOs, often ranging from INR 60,000 to INR 3,00,000 per month.

Q: How often should I meet with my Virtual CFO?

A: This depends on your business needs. Some companies meet weekly, others monthly, or even quarterly.

Q: Can a Virtual CFO help with fundraising?

A: Absolutely. They can prepare financial projections, assist with investor pitches, and guide you through the due diligence process.

Q: Is a Virtual CFO the same as a financial consultant?

A: Not exactly. While both offer financial advice, a vCFO provides ongoing strategic guidance, while consultants are usually project-focused.

Final Thoughts

So what does the designation Virtual CFO equate to in terms of your company? It's an alternative to startup companies, small businesses, and emerging companies needing seasoned financial wisdom and direction, without having to take on a full-time CFO. Everything from managing your cash flow to your strategy could be supplied by a Virtual CFO that serves your firm, propelling it into profitability.