Running a mid-size business is a delicate balancing act. Growth brings excitement, but it also comes with new challenges and vulnerabilities. Whether it's an economic downturn, a supply chain disruption, or an unexpected market shift, crises can hit unexpectedly and hard. The good news is that you don’t just have to survive through tough times—you can thrive. Here’s how to crisis-proof your mid-size business with financial strategies that truly work.

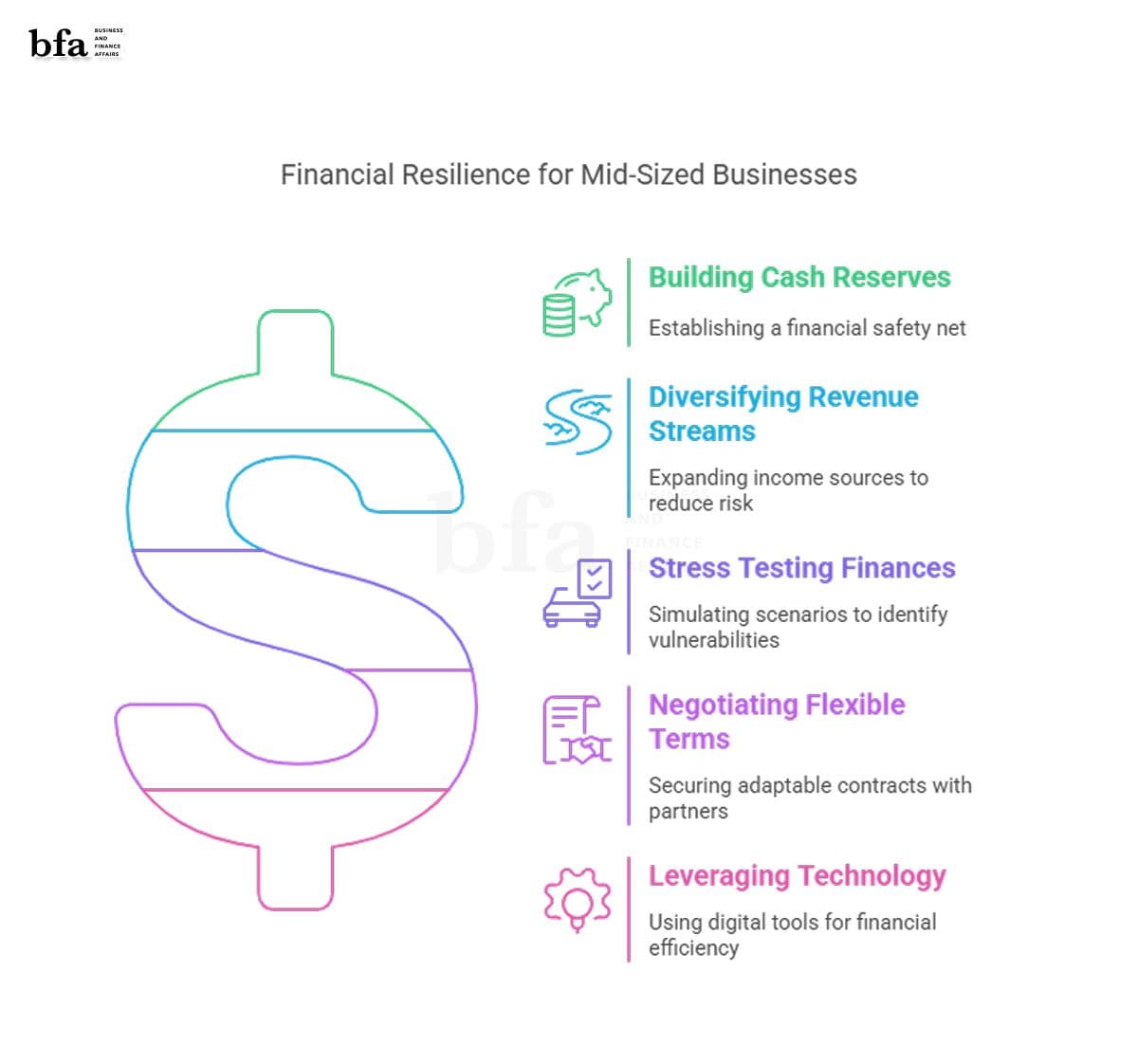

1. Build a Cash Cushion (Before You Need It)

Cash flow is the lifeblood of any business, but it's especially critical for mid-size firms. Too often, businesses get caught off guard because they’re stretched thin while chasing growth. A solid cash reserve—think 3 to 6 months of operating expenses—can be your safety net when revenue dips.

How to Start: Review your monthly burn rate and set a savings target. Trim non-essential costs (that unused software subscription, for example) and redirect those savings into an emergency fund.

Pro Tip: A Virtual CFO can analyze your cash flow patterns and pinpoint exactly how much you need and how to reach that goal without hindering your growth.

2. Diversify Your Revenue Streams

Relying on a single client or product is a risky proposition, especially when a crisis strikes. Mid-size businesses often have the resources to explore new avenues, so make use of them. Diversification doesn’t require reinventing the wheel—it could be as simple as offering a complementary service or tapping into a new market.

Real World Example: A mid-size manufacturer in India we worked with pivoted from solely B2B sales to adding an e-commerce arm during a supply chain crunch. The result? They not only survived but grew their revenue by 15%.

How to Do It: Assess your current offerings and customer base. What’s one small add-on or untapped audience you could target? A financial advisor can help analyze the numbers to ensure it’s a sound investment.

3. Stress-Test Your Finances

You wouldn’t drive a car without checking the brakes—so why run your business without testing its resilience? Stress testing means simulating worst-case scenarios (e.g., a 30% sales drop) to see where your finances crack under pressure.

Why It Matters: Stress testing reveals weak spots, such as overreliance on a single supplier or inflated overhead, before they turn into emergencies.

Action Step: Map out your fixed versus variable costs and model a few “what-if” scenarios. Not sure where to start? A Virtual CFO can run these simulations and create a tailored contingency plan for your business.

4. Negotiate Flexible Terms Now

Crises often expose the rigidity in long-term contracts—think leases or supplier deals that lock you in. Mid-size businesses typically have more negotiating power than startups, so use it to your advantage. Flexible terms give you breathing room when cash gets tight.

How to Approach It: Reach out to vendors or landlords and request scalable payment options or shorter contract commitments. Frame it as a mutually beneficial strategy for long-term partnerships.

Bonus: A seasoned financial strategist can handle these negotiations for you, ensuring you don’t leave any money on the table.

5. Leverage Technology for Efficiency

Manual processes, like tracking expenses in spreadsheets, become a liability in a crisis. Mid-size businesses can’t afford inefficiencies when every dollar counts. Tech tools like cloud-based accounting (e.g., QuickBooks, Zoho Books, Xero) or automated forecasting can save time and money.

Quick Win: Integrate a tool that syncs with your bank accounts and provides real-time financial insights. Pair it with expert oversight, and you’ll have a crisis-ready system in place.

Our Take: We’ve seen SMBs cut reporting time by 50% with the right tech stack, giving them more time to focus on strategy instead of scrambling.

Why You Don’t Have to Do This Alone

Here’s the catch: crisis-proofing isn’t a one-time fix—it’s a mindset. Mid-size businesses often lack the in-house bandwidth to stay ahead of financial risks while managing day-to-day operations. That's where a Virtual CFO can step in. Think of us as your part-time financial quarterback, providing big-picture strategy without the full-time price tag.

From building cash reserves to stress testing your books, we've helped dozens of mid-size businesses turn uncertainty into opportunity. Ready to make your business bulletproof? Let’s chat. Book a free consultation 30-minute financial health check with us, and we’ll pinpoint your next step—no strings attached.